DISRUPTORS ARE WHY WE HAVE A PLAN

Lucidity Ledger — Insights for the Learned Investor

July 20, 2024

disruptor

noun

A person or thing that prevents something, especially a system, process, or event, from continuing as usual, or as expected.¹

Disruptors are why we have a plan. A solid, holistic financial plan that accounts for how we hope the next several decades of life will go and how life may end up going, should the worst-case scenario happen (while also accounting for various shades of gray in between). Is the worst-case scenario likely to happen? No. Is it possible? Definitely. Many of us, individually and collectively, are just one or two poor decisions (or one or two links in a bad chain of events beyond our control) away from a very different life course.²

Disruptors are why financial planning matters. Financial planning, done correctly, is having a process that empowers you to consistently make wise decisions in the face of uncertainty.

By definition, disruptors are unexpected. Disruptors DISRUPT. Whether the headline is an attempted assassination, global pandemic, natural disaster, trade war, recession, housing market crash, terrorist attack, internet bubble crash, or whatever else happens next, one thing we know is that disruptors are unpredictable.

As we review the first half of 2024, we recall that things have been predictably unpredictable. Positives include that we are coming off stronger-than-expected economic growth and robust returns from the AI-driven technology sector (thank you, Nvidia), which has benefited the tech-heavy NASDAQ index and broader-market S&P 500 index year to date. Less positive is our persistently sticky (although recently decelerating) inflation and the fact that we are still waiting for the first of several expected rate cuts that many "experts" (including some Federal Reserve officials) were predicting would happen at the beginning of the year but have yet to materialize.³ As we enter the third quarter of 2024, all eyes are on the Federal Reserve (Fed) for a possible interest rate cut before year-end. We also await a contentious Presidential election in November that will likely add more noise in the coming months.⁴

Economy and Markets

The U.S. economy remained relatively robust throughout the second quarter of 2024. However, there are signs that it is beginning to soften. Unemployment claims are creeping higher, job openings are creeping lower, and consumer spending is showing signs of slowing, even at the grocery store.⁵

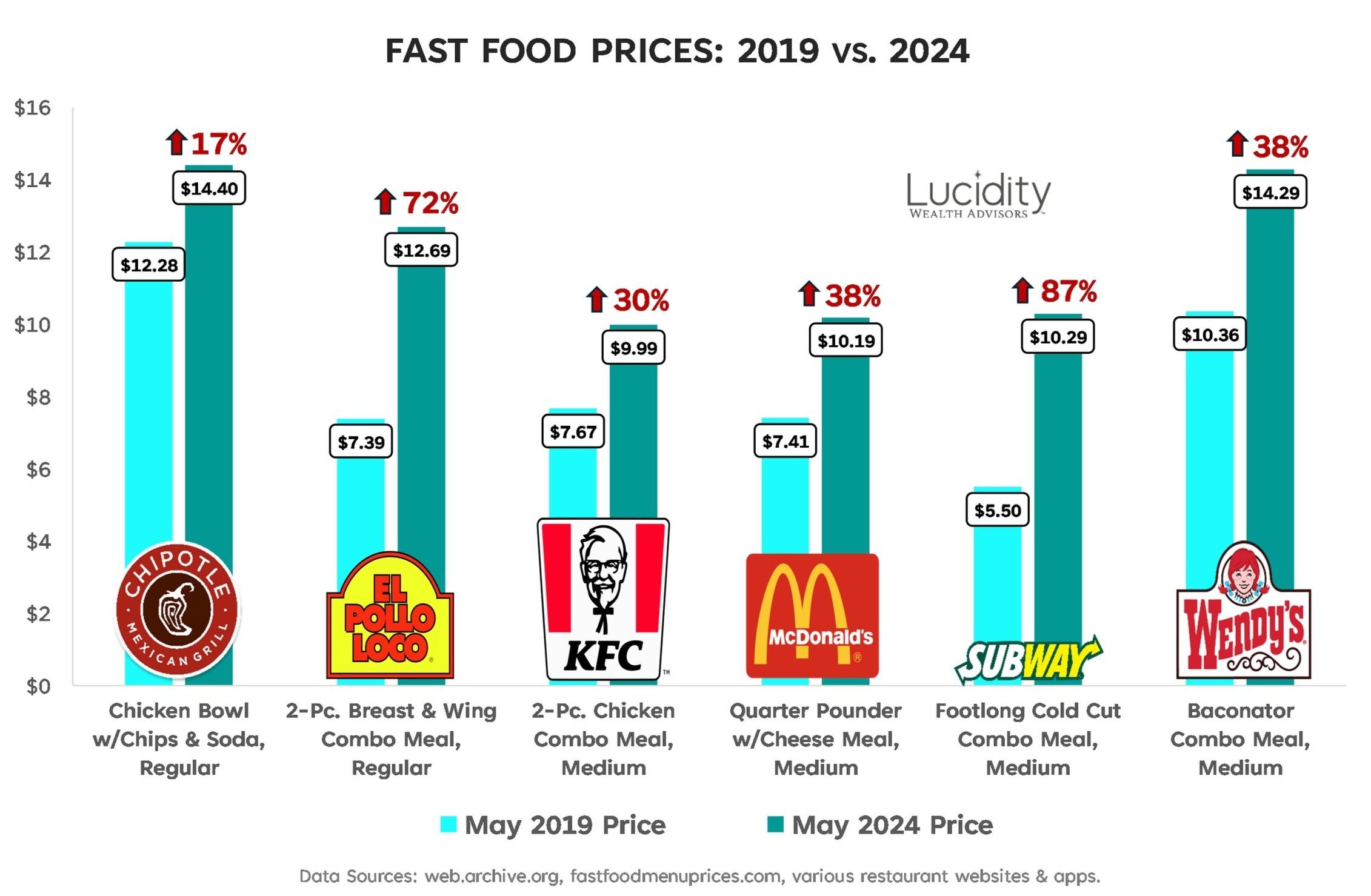

Inflation in the U.S. has come down as measured by the most recent Consumer Price Index (CPI) numbers. While this is good news, it's also helpful to keep the data in the context of the broader picture. Officially, CPI did decline 0.1% from May to June, though this tenth-of-a-percent decline is still coming off a once-in-four-decades record-high inflation rate that peaked over 9% just two years ago (inflation data in March 2022 was the initial catalyst for the Fed's 11 total rate increases since).⁶ While inflation in the U.S. is improving (and the better it gets, the sooner the Fed should start lowering rates, which will bring some much-needed relief to borrowers), prices in general are still considerably higher compared to just a few years ago, and consumers continue to feel the effects.⁷

Globally, inflation outlooks have improved, and both the Bank of Canada and the European Central Bank cut interest rates in the second quarter after holding rates steady for several months.⁸

U.S. equity markets maintained their gains and continued to grow during the second quarter of 2024, with solid rallies from the technology sector leading the S&P 500 and NASDAQ market indices to new highs. Globally, Europe and China continue to struggle with weak economic activity, while India and Japan show signs of resilience.⁹

U.S. fixed-income markets remain stable ahead of the Fed's anticipated rate cut sometime before year-end. Bonds are attractive on a risk-adjusted basis, with high starting yields leading to more income while investors wait for rates to pivot back down. At that point, we should also begin to see some price appreciation on existing bond holdings.

Upcoming U.S. Presidential Election

Over the long run, election years do not matter much for your portfolio's overall performance or for meeting your long-term goals. What does matter is your overall asset allocation, remaining diversified among several asset classes, strategically rebalancing your portfolio when opportunities arise, optimizing tax efficiencies to help you keep more of your profit in your pocket versus returning it to Uncle Sam, and managing your cash flow and spending.

Between now and November 5, we expect some market swings, just like we always expect market swings over brief snapshots in time. Despite the temporary volatility that typically occurs during election years, history reminds us that markets continue to rise regardless of who is in charge.

Takeaway

Disruptors and how best to deal with them are why we have a financial plan. Having a plan allows us to concentrate on our long game despite distracting conditions. Having a plan helps us maintain a disciplined investment strategy designed to support us in reaching our goals. Having a plan helps us make informed decisions when navigating conditions often beyond our control. Having a plan helps us know what to do in the short term so we can stay on track over the long term.

If you are reading this and do not currently have a plan, or would like a second opinion on one you do have, reach out to us and we'll help get you on the right path.

¹ Cambridge English Dictionary, https://dictionary.cambridge.org/us/dictionary/english/disruptor#

² We publish this a week after the attempted assassination of Donald Trump, our former U.S. president and current U.S. presidential candidate. Whether you agree with Trump's politics or not, most of us will agree this was a dark stain on our nation's history and a reminder of our increasingly fragile democracy. Had it played out as intended, we would be having a very different discussion today.

³ Are you noticing a theme yet? The best predictions (even by the "experts)" are often wrong. Yet another reminder that most of life is, in fact, unpredictable.

⁴ This might be the understatement of the year.

⁵ If you find yourself at the grocery store skipping over the 10-pack of Mini Cokes costing $7.49 (that's right: $0.75 each for a scant 7.5 ounces of flavored sugar water. Have they no shame?) or waiting for the "buy 3, get 2 free" special on the peanut butter aisle, you're not alone. https://www.npr.org/2024/07/12/nx-s1-5037875/inflation-food-prices-grocery-supermarket-wages

⁶ https://www.cnbc.com/2024/07/11/cpi-inflation-report-june-2024.html

https://www.bankrate.com/banking/federal-reserve/history-of-federal-funds-rate/

⁷ Last quarter, we showed readers recent price increases for some everyday grocery items, and the numbers were startling. If you missed it, check it out here: https://www.luciditywealth.com/insights/normals-just-a-setting-on-my-dryer

⁸ Q2 Market in Review, July 10, 2024, www.my.dimensional.com

⁹ 2024 Midyear Outlook, www.capitalgroup.com

This commentary is only general information and should not be construed as investment, tax, or legal advice. You should consult your own investment, tax, and legal advisors before engaging in any transaction. Past performance of any market results is no assurance of future performance. The information presented within has been obtained from sources believed to be reliable but is not guaranteed.

Do you have questions about applying these ideas to your unique situation or about anything else related to money, investments, or financial education? We are happy to help get you on track! Contact us for a complimentary, no-obligation conversation.